Pre-set standard tax base

In this section, we answer frequently asked questions concerning the "pre-set standard tax base" and its taxation. The objective is to provide an understanding of the tax regulations and to let the investment account holders know that the pre-set standard tax base may be subject to taxation at the beginning of a year. The legislator requires the entity managing the custody account, i.e. Fondsdepot Bank, to collect the taxes incurred on the pre-set standard tax base. We endeavour to make this process as transparent as possible. Alternatively, you can download the print version in PDF format or take a glance at the explanatory video of the German Investment Funds Association (BVI).

Due to the negative prime rate used to determine the upfront lump sum, no upfront lump sum will be charged for 2021 (inflow 2022) and 2022 (inflow 2023).

An advance lump sum was calculated for 2023 (inflow 2024). The base interest rate for calculating the 2023 advance lump sum is 2.55%.

An advance lump sum is also calculated for 2024 (inflow 2025). The base interest rate for calculating the 2024 advance lump sum is 2.29%.

As a matter of principle, investment fund investors are subject to taxation at the beginning of every year on the basis of a pre-set standard tax base (for the first time from 2 January 2019). The capital gains tax for this standard tax base is calculated by the entity managing the custody account and directly paid to the tax authorities. From the economic perspective, the pre-set standard tax base represents an advance taxation of future value increases of the fund assets. The pre-set standard text base is governed by Section 18 of the German Investment Tax Act (InvStG).

Fondsdepot Bank has no influence on the calculation of the pre-set standard tax base. WM Datenservice® makes the pre-set standard tax rate available to all entities that manage custody accounts for every fund.

As a matter of principle, WM Datenservice® calculates the pre-set standard tax base for a fund by means of a three-stage procedure.

In the first step (A), it is checked whether the fund share gained any value in the course of the last calendar year. For this, the redemption price at the beginning of the year is compared with the redemption price at the end of the year. A pre-set standard tax base comes about only if the value of the fund share has increased. If the value of the fund share has not increased, there is no pre-set standard tax base.

If the first step indicates a value increase, the second step (B) is a comparison of the base income defined by the legislator with the total distributions of the fund in the last year. A pre-set standard tax base is established only if the base income is higher than the total distributions of the fund.

According to law, the base income is defined as follows:

Base income = redemption price at the beginning of the year * base interest rate1 * 70%

If the second step indicates that the base income is higher than the total distributions, the third step (C) will be the determination of the pre-set standard tax base. If the value increase of the fund share plus the total distributions is below the base income, the pure value increase corresponds to the amount of the pre-set standard tax base. In the other case, the pre-set standard tax base corresponds to the base income less the total distributions.

[1] Statutory interest pursuant to Section 18 (4) of the German Investment Tax Act (InvStG)

Pursuant to Section 16 (1) no 2 of the German Investment Tax Act (InvStG), the pre-set standard tax rate is referred to as income. The pre-set standard tax base is thus subject to the normal taxation rules for income and sales profits, i.e. it is subject to withholding tax.

1. Calculation of the capital gains tax

Pursuant to Section 18 (3) of the German Investment Tax Act (InvStG) the pre-set standard tax base will be deemed received on the first workday of the subsequent calendar year. In this way, the tax is charged on the "pre-set standard tax base" income. After WM Datenservice® determines and delivers the basis for calculating the pre-set standard tax base, the entity managing the custody account calculates the capital gains tax, the solidarity surcharge and the church tax on the basis of the custody account holder's or beneficial owner's personal data. This is done under consideration of any partial exemption rates that apply to the fund, any existing exemption orders that have not been fully utilised and any existing loss offsetting pools. The calculated capital gains tax, the solidarity surcharge and any church tax are shown to the customer in a custody account statement.

2. Offsetting of the capital gains tax on the pre-set standard tax base in the case of future sales

From the economic perspective, the capital gains tax on the pre-set standard tax base represents an advance taxation of future value increases. Therefore, it is offset against the taxation of a sale of the respective shares. On the day of the sale – which may be several years in the future – all capital gains taxes paid so far on the pre-set standard tax base are offset against the tax due on the sales proceeds.

The basis for the calculation of the pre-set standard tax base is determined by WM Datenservice® for every fund and made available to the entities that manage custody accounts. The provision of the data for the first fund is expected to begin in early January and be completed before the end of the month.

The capital gains tax on the pre-set standard tax base is always calculated for the fund shares held by the customer at the beginning of the year. Soon after the provision of the pre-set standard tax base data of a fund, Fondsdepot Bank performs the taxation of a customer's custody account portfolio. If a customer holds various funds in his custody account portfolio, the calculation of the capital gains tax on the pre-set standard tab base for the funds may take place at different times.

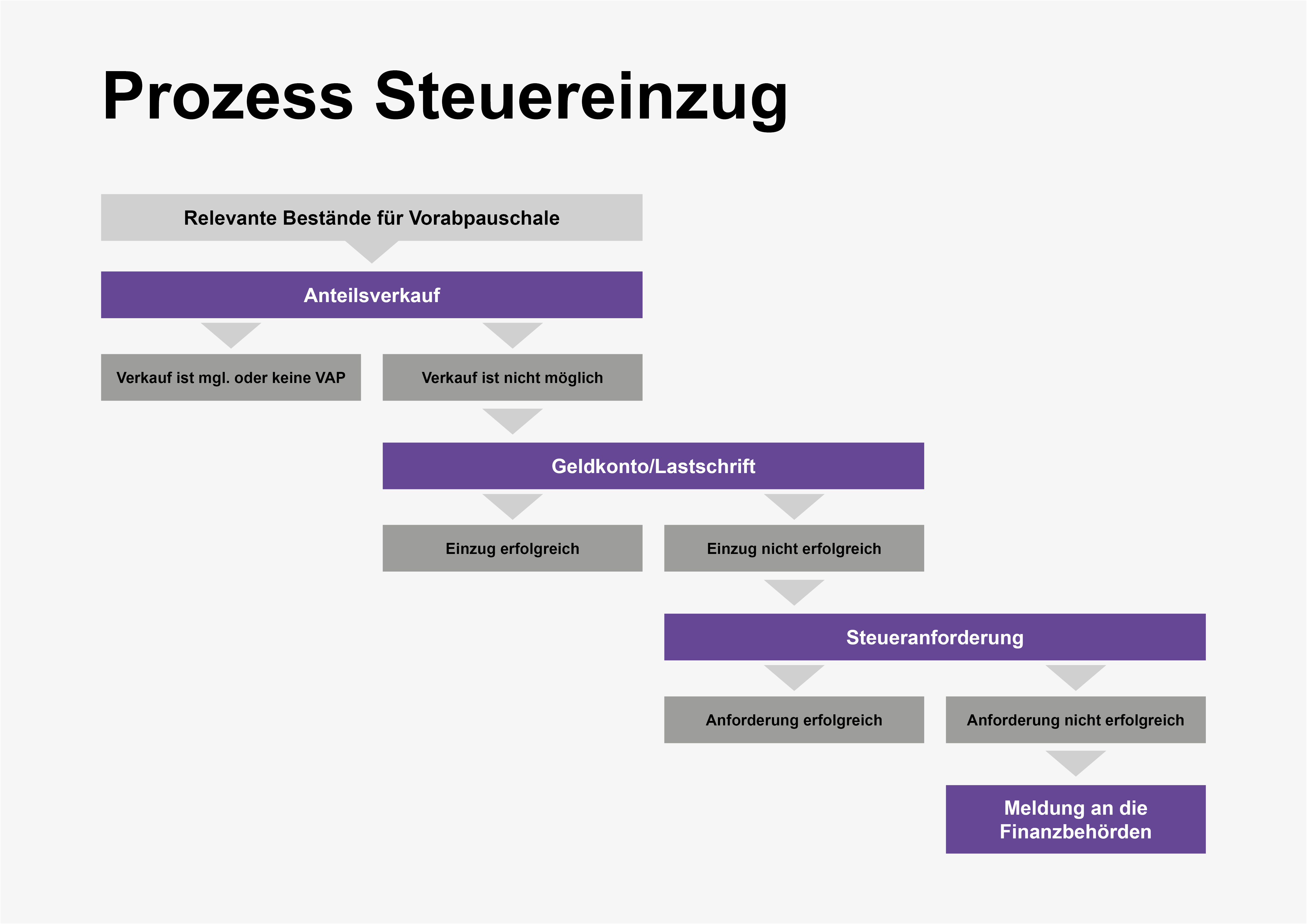

As the calculated capital gains tax on the pre-set standard tax base is a separate business transaction, it cannot be offset against other transactions. The tax thus needs to be collected by the entity managing the custody account. As described below, the collection of the capital gains tax on the pre-set standard tax base at Fondsdepot Bank takes place according to a defined process. After collecting the tax from the customers, Fondsdepot Bank will transfer the collected tax to the responsible revenue office.

1. Sale of shares

After receiving the basis for calculation of the pre-set standard tax base for a fund from WM Datenservice®, Fondsdepot Bank determines the fund shares held by the customers and calculates the capital gains tax, the solidarity surcharge and, if applicable, the church tax for each customer on the basis of their portfolio and tax situation (see also 1. under "How is the pre-set standard tax base taxed?").

To settle the tax claim, Fondsdepot Bank will sell the required number of shares from the portfolio of the respective fund. Of course, the sale is only possible insofar as no circumstances preventing the sale exist for the fund, the custody account or the portfolio.

Fondsdepot Bank automatically calculates the number of shares to be sold to settle the tax due under consideration of the tax that accrues from the sales transaction executed. This transaction does not require a separate order of the customer. The sale is documented to the customer with a sales custody account statement.

2. Direct debit

Usually, the tax on the pre-set standard tax base is collected via direct debit if the shares cannot be sold and Fondsdepot Bank has a reference bank account with a valid SEPA mandate. The customer is notified of the direct debit with the custody account statement for the pre-set standard tax base.

3. Tax request

The tax request will be sent if the shares could not be sold and the direct debit was not possible. A tax request is a letter requesting the customer to pay the tax calculated for the pre-set standard tax base for a fund within 14 days. The statement sent with the tax request shows the tax due and specifies the account to which the customer needs to pay his tax debt. To enable due allocation of the amount paid, it is important to specify the purpose mentioned in the letter in the transfer.

4. Notification of the revenue office

If the aforesaid measures to collect the taxes are not successful, Fondsdepot Bank is under the obligation to report the customer with the unpaid tax claim to the revenue office. The tax authorities will then endeavour to collect the taxes.

For the calculation of the tax on the pre-set standard tax base and the collection of the taxes to proceed as smoothly as possible, it is important to understand that the collection of taxes on the pre-set standard tax base is a statutory requirement under the German Investment Tax Reform Act (InvStRefG). The entities managing the custody accounts have been commissioned by the revenue office to calculate and collect the taxes. If no pre-set standard tax base is incurred for a fund, no tax burden will accrue either. A custody account customer can prepare by taking the measures specified below.

1. Adapt exemption order

As the pre-set standard tax base is assessed and the taxes due are calculated at the start of a calendar year, an existing exemption order that has not been exhausted would be helpful to minimise the amount of tax collected.

2. Verification of the reference account

To collect the tax via direct debit, Fondsdepot Bank needs reference bank details with a valid SEPA mandate. The customer can perform the following preparatory measures:

- If Fondsdepot Bank has not been provided with any reference bank details so far, these details can be submitted.

- If reference bank details have been provided, it should be checked whether the said account still exists and has a valid SEPA mandate.

As of the end of the 2018 calendar year, a custody account has three positions. The officially published applicable base interest rate (2 January 2019) is 0.52 percent.

| Pos. | Portfolio/purchase since/on | Number of shares | Fund type | OP on the day of the purchase | RP 01.01.2019 | RP 31.12.2019 | Distribution |

|---|---|---|---|---|---|---|---|

| 1 | 01.01.2018 | 5 | Accumulating | n/a | €10.00 | €10.50 | n/a |

| 2 | 15.07.2018 | 50 | Accumulating | €80.00 | €75.00 | €78.00 | €1.50 |

| 3 | 01.01.2018 | 1000 | Accumulating | n/a | €200.00 | €200.50 | n/a |

Calculation

Step A

Is the difference between the redemption price of the fund unit as of the beginning of the year and end of the year (value increase) positive? [RP 01.01.2019 > RP 31.12.2019]

| Pos. | Rule | Calculation | Result |

|---|---|---|---|

| 1 | RP 31.12.2019 higher than on 01.01.2019 | €10.50 - €10.00 = €0.50 VI | PSTB "yes" |

| 2 | RP 31.12.2019 higher than on 01.01.2019 | €78.00 - €75.00 = €3.00 VI | PSTB "yes" |

| 3 | RP 31.12.2019 higher than on 01.01.2019 | €200.50 - €200.00 = €0.50 VI | PSTB "yes" |

Step B

Is the redemption price at the start of the year x 70 percent of the base interest higher than the (total) amount of the distribution(s) in the year?

Base income = RP at the start of the year * (70% of the base interest)

= RP at the start of the year * (0.7 * 0.52%)

= RP at the start of the year * 0.364%

| Pos. | Regel | Calculation | Result |

|---|---|---|---|

| 1 | Base income > total distributions | Base income: €10.00 * 0.364% = €0.0364 / total distributions: €0.00 -> base income > total distributions | PSTB "yes" |

| 2 | Base income > total distributions | Base income: €75.00 * 0.364% = €0.273 / total distributions: €1.50 -> base income < total distributions | PSTB "no" |

| 3 | Base income > total distributions | Base income: €200.00 * 0.364% = €0.728 / total distributions: €0.00 -> base income > total distributions | PSTB "yes" |

Step C

Is the value increase of the fund share + the amount of the distribution(s) greater than the base income?

| Pos. | Rule | Calculation | Result |

|---|---|---|---|

| 1 | Value increase + distribution (VI + D) ≥ base income (BI) | Value increase: €10.50 - €10.00 = €0.50 / distribution: None/base income: €0.0364 -> VI+D > BI -> base income as basis | PSTB = €0.04 |

| 2 | Value increase + distribution (VI + D) ≥ base income (BI) | n/a | No PSTB |

| 3 | Value increase + distribution (VI + D) ≥ base income (BI) | Value increase: €200.50 - €200.00 = €0.50 / distribution: None/base income: €1.218 -> VI + D < BI -> VI + D as basis | PSTB = €0.50 |

Result

Calculation of the PSTB (without taking loss offsetting balances, exemption orders, church tax and solidarity surcharge into account)

| Pos. | Rule | Calculation | Result |

|---|---|---|---|

| 1 | Number of shares * PSTB * 25% capital gains tax | 5 * €0.0364 * 25% = €0.045 | Capital gains tax = €0.05 |

| 2 | Number of shares * PSTB * 25% capital gains tax | n/a | No capital gains tax from PSTB |

| 3 | Number of shares * PSTB * 25% capital gains tax | 1000 * €0.50 * 25% = €125.00 | Capital gains tax = €125.00 |

Taxable transactions, such as sales or outgoing transfers that were carried out at the beginning of the year can only be carried out up to the day on which WM Datenservice® provides the pre-set standard tax base without taking them into account for tax purposes. However, since the pre-set standard tax base is always to be calculated retroactively to the stock on December 31 of the previous year, transactions that are subject to tax that were carried out between the start of the year and the settlement of the pre-set standard tax base must be corrected if necessary. Of course, this initially only affects transactions in funds for which a pre-set standard tax base has accrued and whose transaction has triggered a tax liability.

Do you have further questions about the advance flat rate?

Then send us an e-mail at info(at)fondsdepotbank.de.

We will take care of your request.