Your Mix Depot

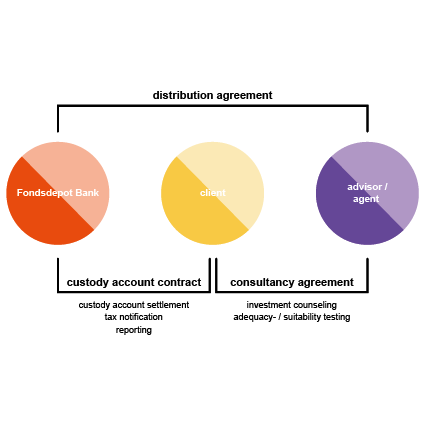

With the Mix Depot of Fondsdepot Bank you can trade through your:n advisor:in funds, exchange traded funds (ETF) and clean share funds* in just one custody account. The big advantage: transparent conditions and a simple pricing model without fund commissions and downstream transaction costs.

- Tradable in one custody account: funds (UCITS), exchange traded funds (ETF) and clean share funds.

- Simple pricing model: Only 0.10% p.a. on the custody account volume (min. 55.00 EUR to max. 350.00 EUR custody account fee).

- No transaction costs.

- Individual advice and execution of all transactions by your advisor.

- Optimal advice and fair remuneration through a transparent service fee model.

- No issue surcharges.

*Clean share funds are funds without commission, i.e. share classes that are not charged with sales fees.

Risk diversification

An investment fund, also called a fund for short, is generally referred to as a pool or pot of capital. It collects money from investors and savers and invests this capital in very different asset classes according to a predefined investment guideline. These can be shares, interest-bearing bonds, real estate and other assets. The advantage for individual investors is that they can make a very broadly diversified fund investment even with small amounts, which is also managed professionally and on a daily basis.

Protection

Investment funds are special assets. Special assets are the investment capital of the fund investors, which is separated from the assets of the investment company or the capital management company (KVG). This separation protects the investment fund from being accessed by the investment company itself or its creditors (even in the event of insolvency). It is therefore not subject to the KVG's insolvency estate, which eliminates the default risk for investors.

Flexibility

Investing in investment funds is very flexible. Investors can invest once or place monthly savings orders. The custodian transfers the collected orders daily at the so-called net asset value (NAV) to the capital management company, which redeems or issues the fund units. This means that investors can buy and sell fund units on a daily basis.

Transparency

Every six months, the fund companies provide comprehensive reports on all transactions. Investors can monitor the performance of investment funds at any time in the press or on the internet.

That's what makes the Mix Depot so popular...

... the one-off investment

You can open a fund custody account for your customers for as little as EUR 250.

... the savings plan

Your customers can purchase fund units on a regular basis for as little as EUR 25 per month.

... the payout plan

Would your clients like to sell their fund investments gradually and receive a fixed amount each month? Then they can benefit from our payout plan from an investment amount of EUR 5,000 and a monthly payout of EUR 25.

... the exchange plan

Invest step by step. Depending on the needs of your clients, they park their one-time investment in a money market fund in the first step and then exchange the units piece by piece for a riskier form of investment.

Price overview

- Securities account model: Mix securities account

- Custody account management fee: 0.1% (10 basis points) of the average custody account value min. 55.00 EUR, max. 350.00 EUR

- Maturity: quarterly

Apart from the custody account fees, there are no further transaction costs, issue surcharges or other incidental acquisition costs. External costs of third-party service providers are passed on to the securities account holder.

The Mix custody account with online access

Use our fund banking service to manage your custody account.

If you have any questions about your custody account, please contact:

Service-Line: +49 9281 7258-3000,

Mon - Fri from 08:00 - 20:00 hrs

E-Mail: info(at)fondsdepotbank.de