Your gold deposit

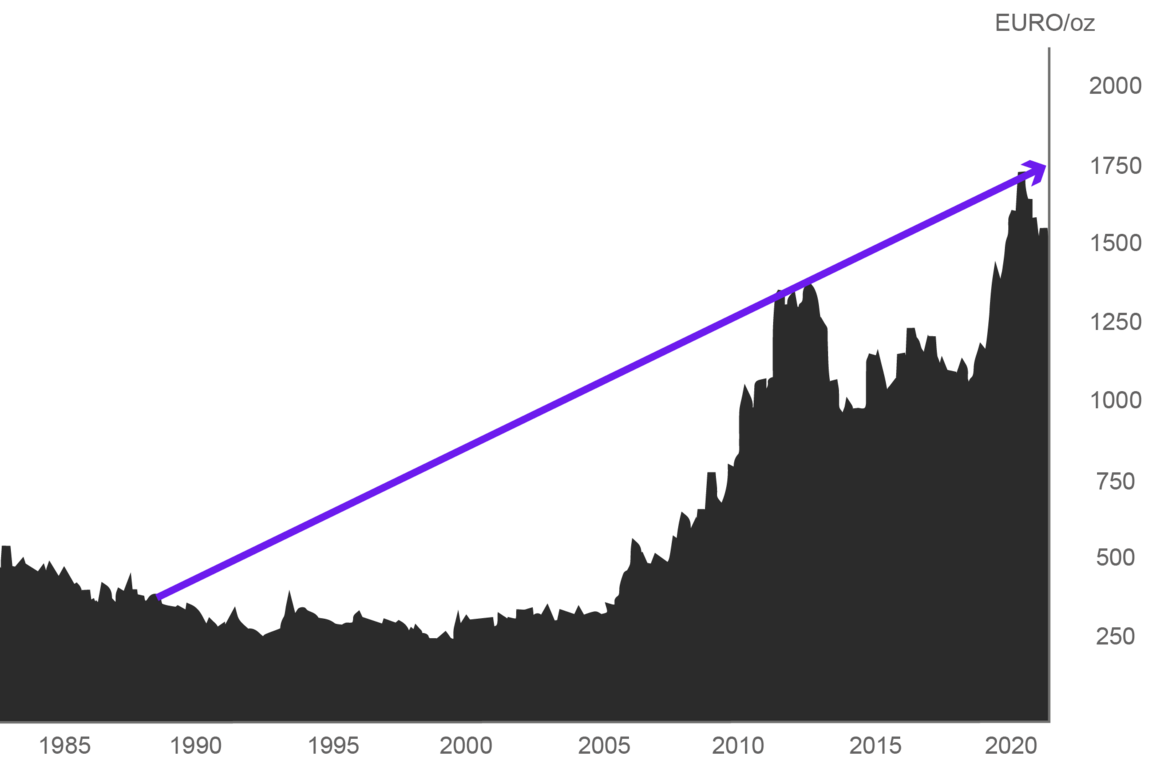

Collecting gold has always been seen in terms of security. It is the only means of payment that has retained its value over thousands of years. For many people, gold is a perpetual guarantor of stability - which is why a gold investment is so interesting. Fondsdepot Bank has developed a product that is a convenient solution for its customers: the gold custody account.

The advantages of investing in gold

What makes an investment in the form of a gold deposit attractive for your customers:

- The gold price remains largely unaffected by the stock markets and offers a hedge against inflation.

- High production costs of gold form a natural price floor.

- The value of gold is based on its rarity and the unbroken high demand.

- A share of one piece of physical gold is acquired per investment rate. Whole pieces of gold can be delivered on request.

- The gold deposit is handled flexibly like an investment fund via the fund banking portal.

- There are no fixed terms and no notice period.

- Possible price gains are tax-free after one year.

Current price of gold

updated on 19.04.2024, 05:15

| WKN | Product | Retail price | Repurchase price |

|---|---|---|---|

| 1211023 | Vienna Philharmonic - Austria 1/4 oz Gold Coin | 620,59 € | 562,17 € |

| 1211016 | Krugerrand 2024 - South Africa 1 oz Gold Coin | 2.453,06 € | 2.248,69 € |

| 1221058 | Gold Bar - 100 g .9999 - Umicore new (cast) | 7.387,66 € | 7.230,50 € |

| 1221050 | Gold Bar - 250 g .9999 - Umicore new (cast) | 18.451,03 € | 18.076,26 € |

| 1221033 | Gold Bar - 500 g .9999 - Umicore New (cast) | 36.883,95 € | 36.152,52 € |

The gold custody account of Fondsdepot Bank

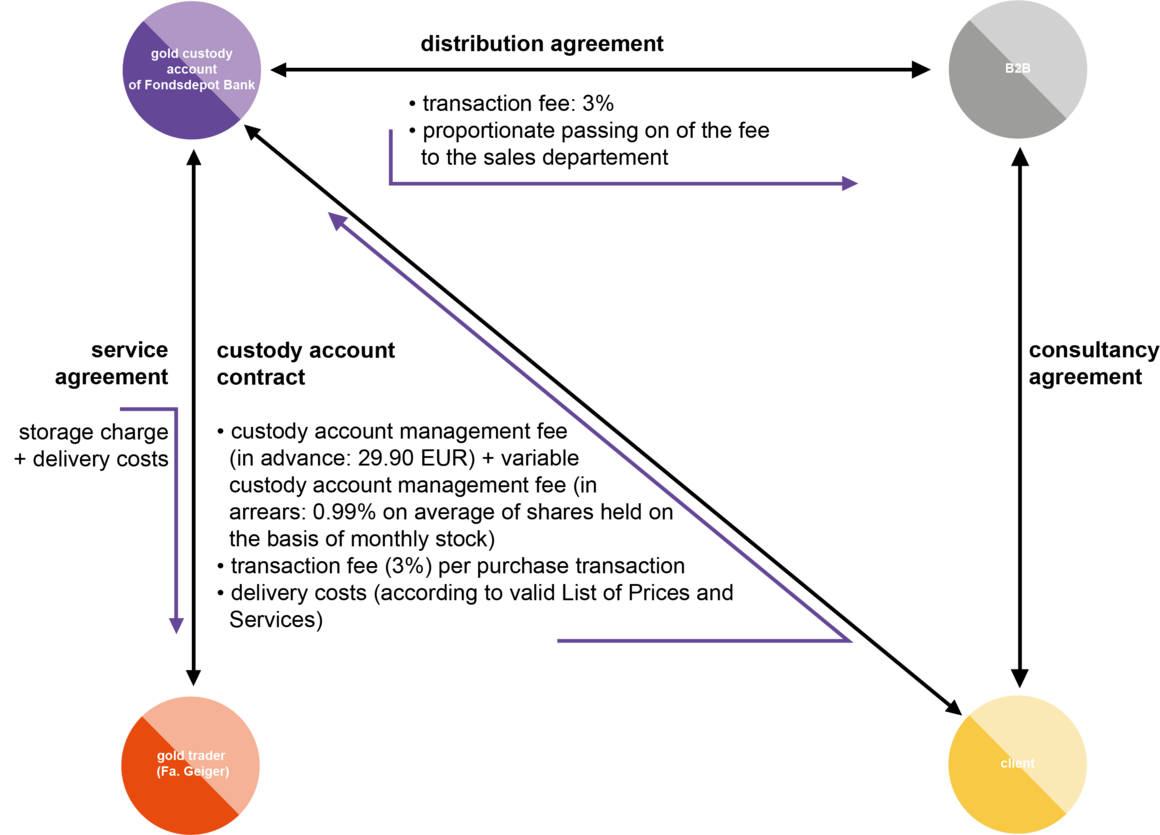

The Fondsdepot Bank offers the option of processing the gold custody account flexibly like an investment fund via the fund banking portal and tracking it online. This makes the gold custody account easier to process and "sell" for your sales department. The distribution of the gold custody account does not require a licence according to §34 GewO.

Investing in a gold custody account is possible as a one-time investment or as a gold savings plan, even with small amounts. Shares in physical gold that have already been purchased are shown in the fund banking portal at the current daily rate. The gold shares can be traded flexibly and without a minimum term at current market conditions. After observing a one-year speculation period, this is even possible tax-free!

How the Fondsdepot Bank gold custody account works

As an advisor, you open a gold custody account for your client via the Fondsdepot Bank and determine the desired investment modalities. With regular and/or one-off investments, your customer comes closer to his or her own savings goal for the desired gold products. Already with the first investment, co-ownership or fractional ownership of the physical gold product is acquired. Once the desired gold product has been saved in full, the savings target is reached and delivery can be requested.

Our gold custody account is attractive and inexpensive. The custody account management fee consists of a favourable basic price of currently EUR 29.90 per year plus 0.99% of the average monthly unit holding. Your customer thus benefits from the flexible services of the Fondsdepot Bank Gold securities account. In addition, there are transaction costs per unit purchase according to the enclosed overview. In the event of delivery, corresponding delivery fees must be paid.

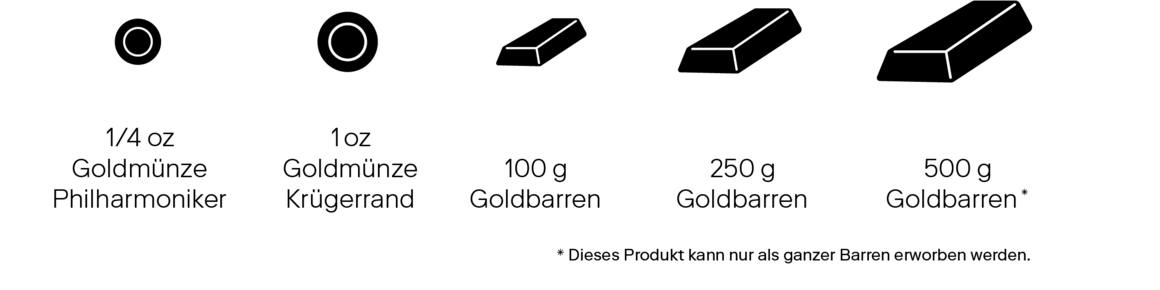

Our gold investment forms at a glance

With the flexible gold savings plan and possible single investments, you can save on selected gold coins and gold bars. We offer you a wide range of options for your gold portfolio.

| Gold Savings Plan Product Range | Minimum investment amounts | Minimum investment amounts |

|---|---|---|

| Product | Savings plan | Single payment/co-payment |

| Gold coin 1/4 oz Philharmonic | €25,00 – monthly | €250,00 |

| Gold coin 1 oz Krugerrand | €25,00 – monthly | €250,00 |

| 250g Gold bars | €50,00 – monthly | €250,00 |

| 500g Gold bars | not possible | from whole bar |

Safe custody

The experienced precious metal dealer Geiger currently manages the physically deposited bars and coins for Fondsdepot Bank.

- Only fine gold with a purity of 999.9 is offered (with the exception of the Krugerrand).

- Geiger stores its customers' gold in a high-security vault near Leipzig.

- The stored gold is contractually the property of your customers and is therefore protected even in the event of insolvency of the Fondsdepot Bank.

- The gold is insured - during storage and transport.

- As a German company, Geiger Edelmetall GmbH is subject to all German laws and obligations.

Contact for questions about your gold portfolio

Service-Line: +49 9281 7258-3000

Mon - Fri from 08:00 - 20:00

mail: info(at)fondsdepotbank.de